Training Program on “Contemporary Applications of Islamic Financial Transactions” Shariah, Legal, & Technical Aspects”

15/04/2024

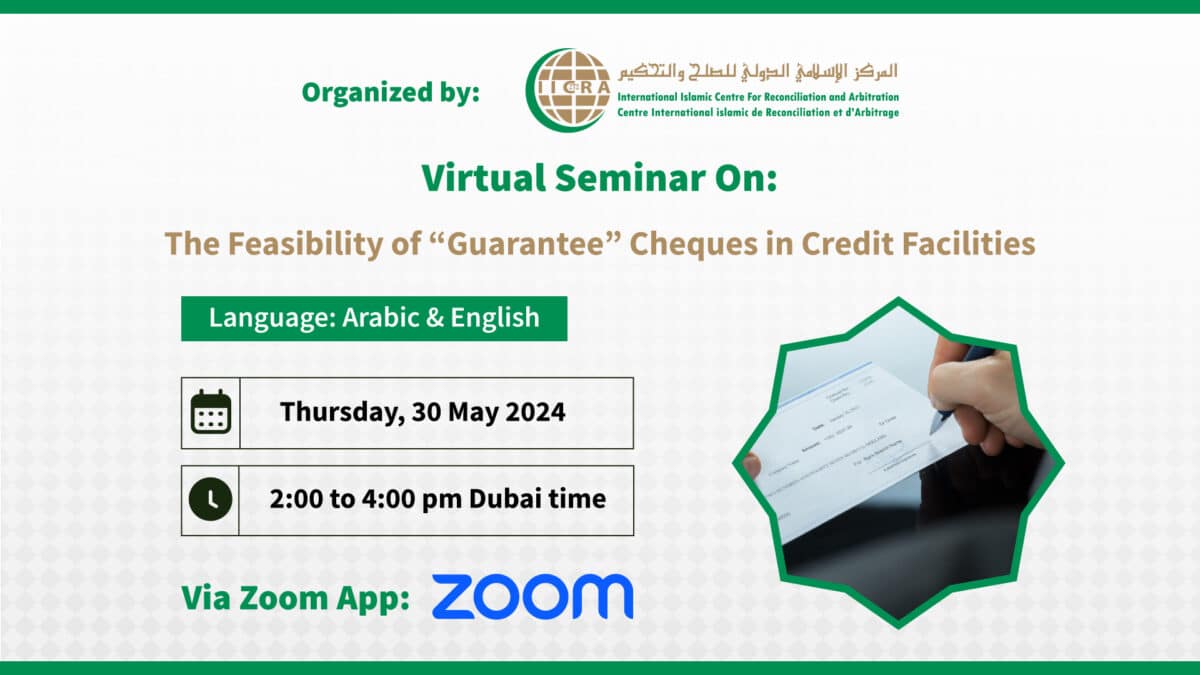

IICRA Seminar On “The Feasibility of Guaranteed Cheques in Credit Facilities”

31/05/2024The Feasibility of "Guarantee" Cheques in Credit Facilities

days

hours

minutes

seconds

About the Seminar

Thursday, 30 May 2024 | 22 Dhul Qadah 1445

Background:

In a noteworthy legal precedent witnessed by the Court of First Instance in the Emirate of Dubai on 30 April 2024, particularly within Dispute No. 117 of 2024 AD, a significant legal contention emerged regarding the processing of cheques issued by a customer against an Islamic financial institution that had extended car financing to him. The customer, in his lawsuit, sought to contest the imposition of executive measures on guarantee cheques held by the Islamic financial institution. Subsequently, the court ruled in favor of the customer's petition. This ruling prompts a closer examination of its specifics, rationales, and supportive arguments, as well as its implications for both conventional and Islamic banking transactions.

Objective:

In light of this ruling's implications, the International Islamic Centre for Reconciliation and Arbitration (IICRA) is organizing a dialogue symposium. This symposium intends to bring together professionals from both conventional and Islamic financial institutions, along with legal experts, to thoroughly analyze the implications of the ruling. Discussions will explore its impact on the structuring of credit facilities, covering legal and Shari’ah perspectives integral to this critical discourse.

Topics:

- Cheques are Mechanisms for Fulfillment and Performance, Not a Guarantee

- Risk Management in Financial Institutions and Guarantee Cheques

- Proposed Alternatives for Credit Facilities Beyond Security Cheques

Participants:

- Legal and Shariah professionals within financial institutions

- Scholars specializing in law and economics

- Law firms, companies, and legal consultancies with a focus on financial matters